More than a mathematical analysis of risks and returns determines the value of a share. It is also affected by how much the investment community knows and understands about the company concerned, and their perceptions of the quality of the firm’s management.

Hence to ensure that their shares are fairly valued, firms need to make every effort to ensure that investors and their advisors have recent frequent clear information about the firm’s situation and plans. The larger and more complex the firm, the more effort is required.

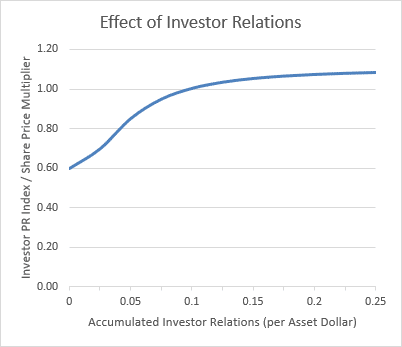

Investor Relations (Investor PR) Index

The Investor Relations (also known as Investor PR) index essentially acts as a multiplier on your company’s share price. So for a very simple example, if your Investor PR index is 1.1, then your Share price will be 10% higher than if your Investor PR index is 1.0 (assuming no other changes). In practice, by spending on Investor PR you will reduce your profit, which will be a drag on your share price, so the effect isn’t quite as simple as that.

In general, the larger your company, the more you need to spend to get a higher PR index. The maximum PR index possible is around 1.2, and you have to spend more and more to raise your index the closer you get to that limit.

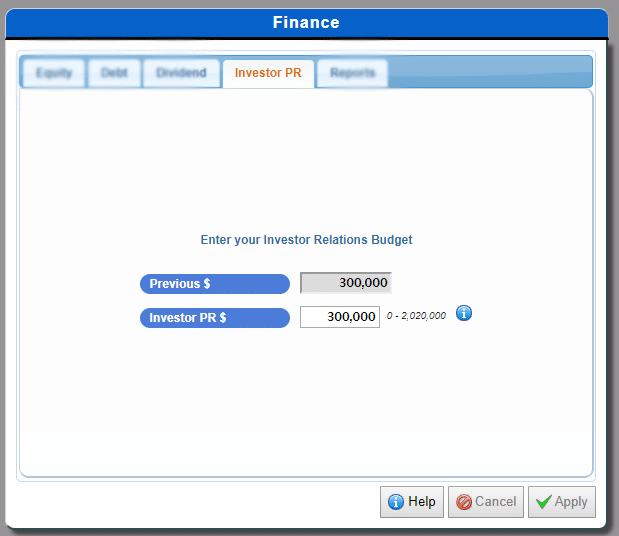

How much should we invest in Investor PR?

Your best guide to how much to spend on Investor PR is to look at your current Investor PR index and spend, then decide how much more you are willing to spend on it to try to boost it. Keep in mind that if you spend too much on Investor Relations you may depress your Share Price by reducing your profit and earnings per share. Also decide whether or not there is another better use for the money spent on Investor Relations such as on Product Development.

View other Question of the Week articles here:

What Does Awareness Index Mean and How Do You Influence It?

How Do We Decrease Our Factory’s Wastage?

How Do We Increase Our Delivery Rate?